Business Connect and Grow

At a glance:

Spearheaded MVP design for Paga’s Merchant Solution (Doroki app), a mobile digital payments acceptance solution tailored for merchants in emerging markets, leveraging user research and UX validation. Launched in partnership with Visa in 2021, Doroki rapidly gained traction with over 6,000 merchants onboarded at launch, driving a 5X surge in transaction volume and value within the first month. This initiative strengthened financial inclusion by digitizing SME operations across Nigeria, aligning with Visa’s mission to support thriving economies and accelerating digital adoption among SMEs.

How might we increase affordability and inclusivity for merchants to make and accept digital payments through a mobile device in emerging markets?

Background

Our project aimed to increase affordability and inclusivity for merchants to make and accept digital payments through a mobile device in emerging markets. Our customer research informed us that small and medium merchants in Nigeria accepted 60% payments via cash. This was primarily because the cost for acquiring a traditional POS was too high for our target merchant persona, and complex rules and lack of education on the subject limited their ability to acquire digital/card payments. We also discovered that beyond the core capability of digital payments acceptance, merchants also desired value-added services such as digital inventory management, payroll, and access to financial products such as loans.

Solution

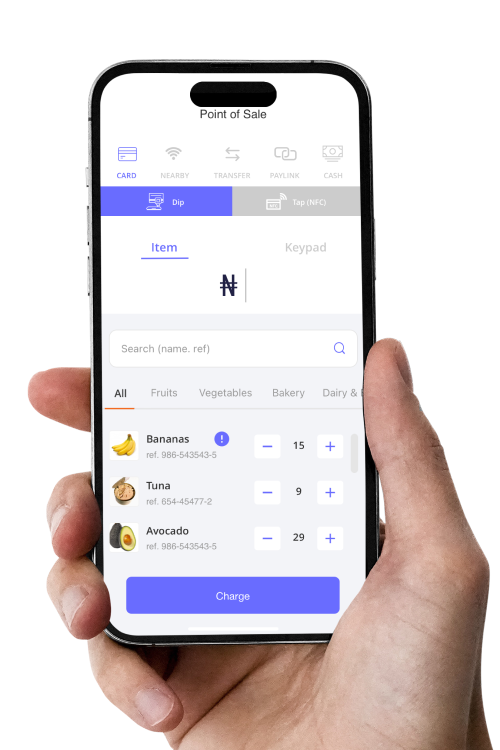

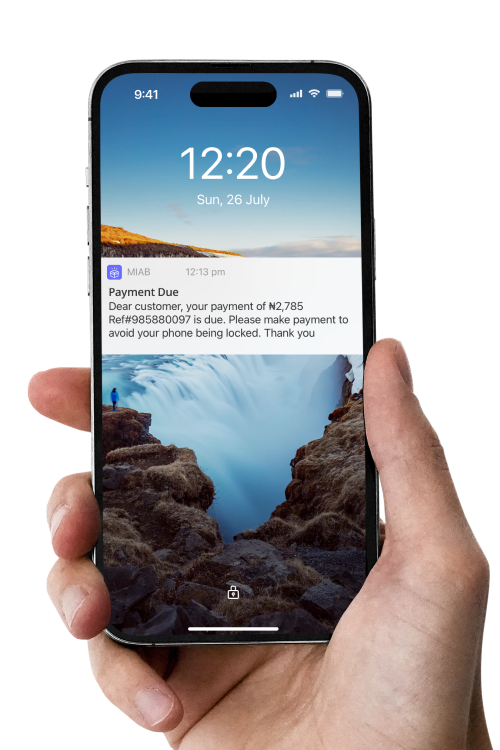

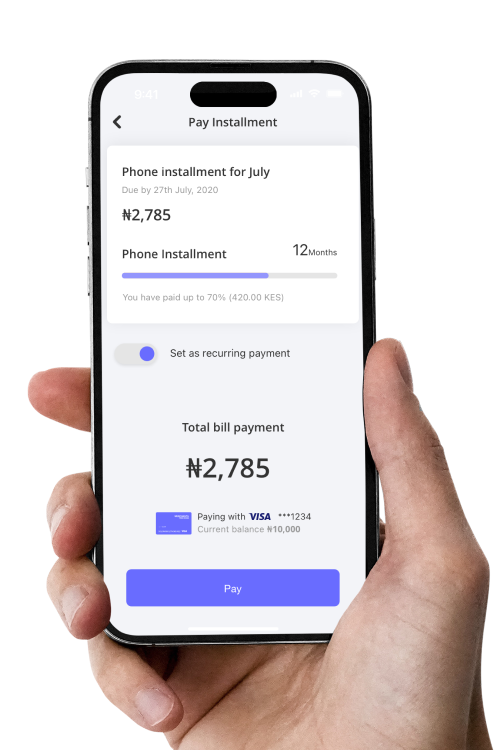

Based on our insights, we partnered with relevant technology partners to develop a solution of a managed device (a POS-enabled mobile phone) loaded with merchant-specific services. Our solution allowed merchants to purchase a Samsung smartphone on installments that is managed through Knox capabilities and enabled with secure Visa payment acceptance and Paga’s merchant tools.

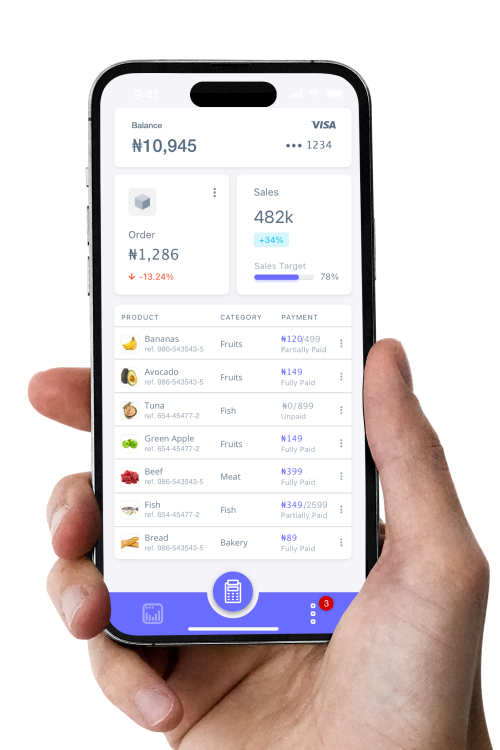

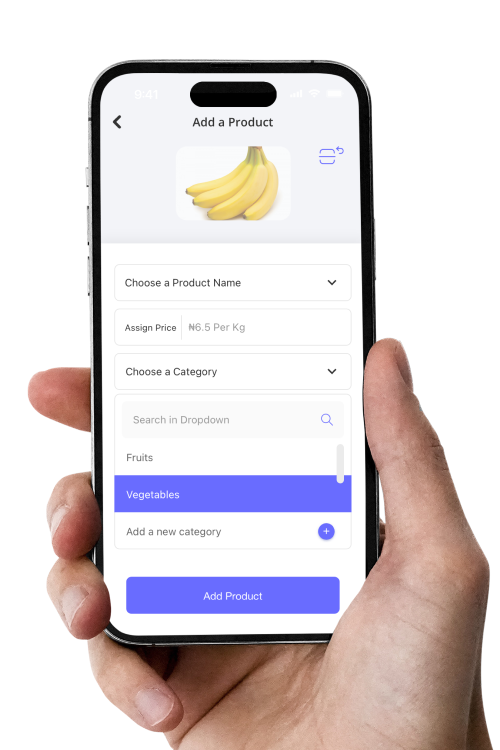

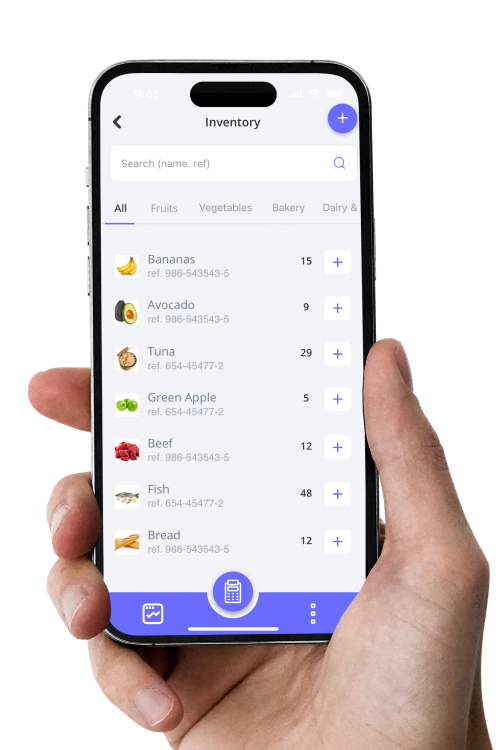

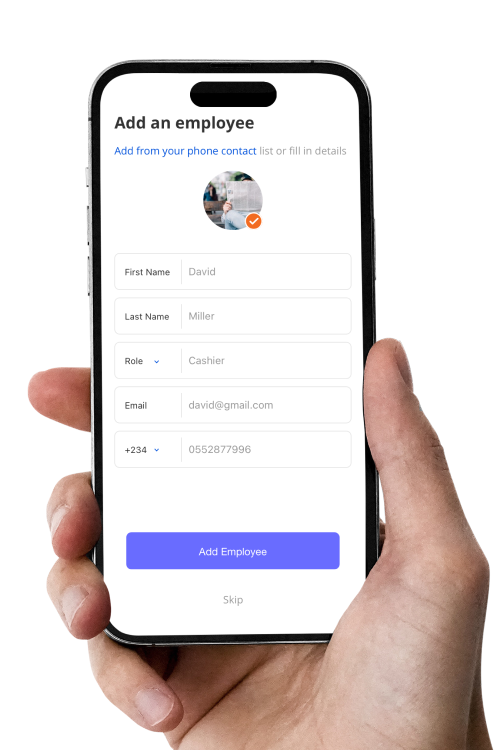

The solution included self-guiding onboarding and card issuance, payment acceptance (card, NFC, pay link, mobile POS transfer, mobile POS cash tracking), employee management, card controls, mobile POS digital receipt, physical receipt, digital inventory, and micro-lending. This solution provided a comprehensive suite of services to meet the needs of small and medium merchants.

My Role

- Co-creation strategy

- User research

- Workshop facilitation

- UI/UX, MVP design

- Cross-functional collaboration

As the co-creation design lead, I worked with a team of engagement managers, SMEs and technology partners to create a user-friendly and affordable digital payment solution for small and medium merchants. I planned and executed extensive qualitative and quantitative user research, which provided us with valuable insights into the needs and pain points of small and medium merchants in Nigeria. Based on these insights, I designed the co-creation strategy and workshop, facilitated co-creation activities, and translated research data into customer stories. I also created customer personas, user journeys, and UI/UX designs to ensure that the final product met the needs of our target audience. These efforts were essential in developing a user-friendly and affordable digital payment solution for small and medium merchants in emerging markets, which has had a significant impact on increasing financial inclusion and promoting the growth of small and medium businesses.

Impact

Over 6000 sellers & 5X growth in transactions

Paga launched the solution in 2021, and it has recorded over 6000 sellers and 5X growth in transaction volume and value in just one month.

Digital payment acceptance and value-added services

The solution has empowered merchants with seamless and cost-effective digital payment capabilities, and value-added services for operational efficiency.

Financial inclusion and SME growth

The solution has contributed to increasing financial inclusion and promoting the growth of small and medium businesses in emerging markets.